Guardcover

Seriously good

insurance for

over 40 years

OUR STORY

See what type of products we cover

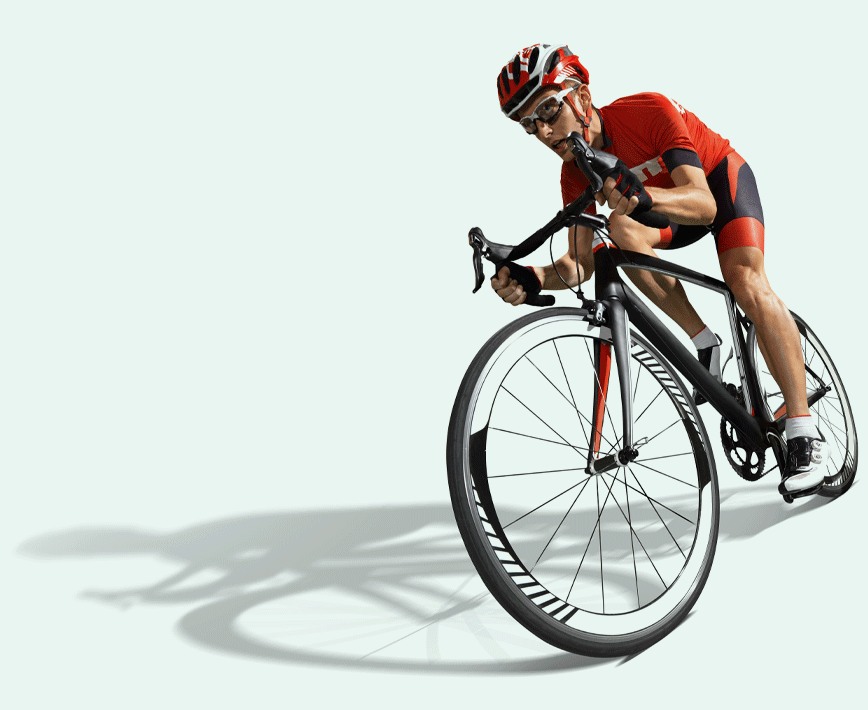

Guardcover is a leading brand of specialist leisure insurance, focused on fulfilling the insurance needs of cyclists, musicians, photographers, property owners and pet owners since 1998.

We have built our reputation on understanding the needs of our customers to support the development of our product range whilst delivering great service to provide customers with the support they need through the insurance journey. Our in-depth knowledge of cycling, music, photography, property and pet care spans over 20 years of serving the insurance requirements of thousands of keen amateurs, professionals and pet owners. So whatever you are serious about, we'll help protect it.

Our Products

Take a look at the products covered by Guardcover, from lifestyle to unoccupied properties.

Our Products

Existing Customers

If you're an existing policy holder then we're here to help with anything you need.

Existing Policy Holders

Our partners

Find out more about our partners and associates

Clifton Cameras

Find out more about our partners

Evans Cycles

Find out more about our partners

Future Publishing

Find out more about our partners

Pet Tags

Find out more about our partners

PETrac

Find out more about our partners

Sports Tours International

Find out more about our partners

TRI UK

Find out more about our partners

Wex Photo Video

Find out more about our partners

Frequently asked questions about guardcover

Want to find out more about our insurance?

If you’re wondering what our insurance includes, then we’ve answered a few questions here!

- Our products

- Our cover

- Security

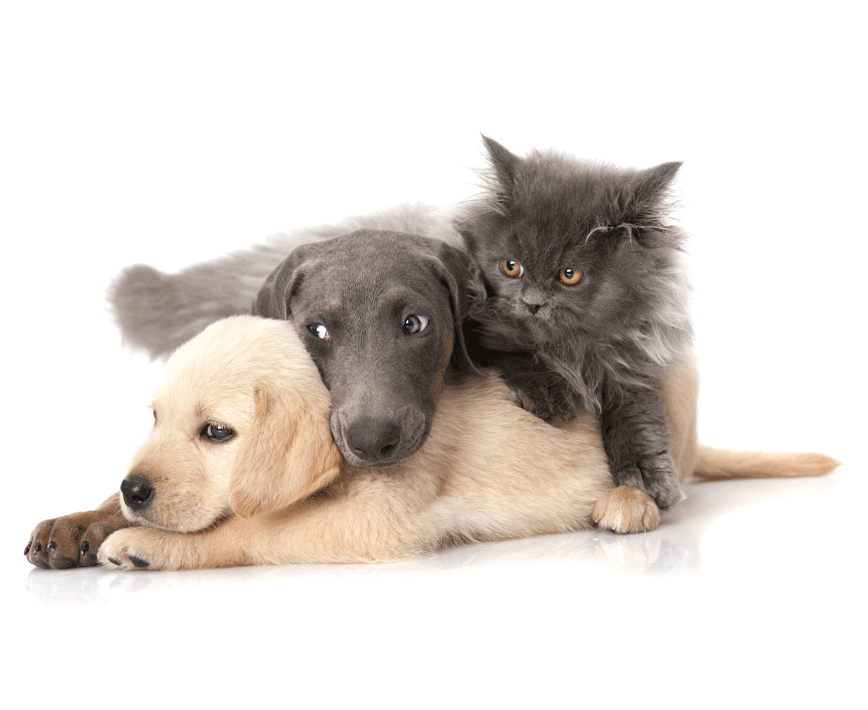

- Do I need to insure my dog?

Insurance for dogs isn't compulsory. But it's worth remembering that owning a dog can be expensive. For example, the cost of vet bills has risen steadily over the past few years. If your dog were to become ill or suffer an injury, could you afford to pay for treatment? By choosing dog insurance, you can give yourself financial protection if something were to happen to your dog.

- Do I need cat insurance?

Cat insurance isn’t mandatory but may be worth considering. Think of it as a financial safety net that’s there to protect you against unexpected costs. After all, you never know when your cat could fall ill or suffer an injury.

The average pet insurance claim can be as much as £793, but that amount can run into the thousands if your cat were to develop an ongoing condition. Ultimately, you have to balance the cost of cat insurance premiums against the risk of incurring a hefty vet bill. But keep in mind that as your cat gets older, it may be more likely to fall ill, which in turn can raise the cost of your cat insurance.

- Can I cover more than one bike on a policy?

Yes, we can cover yours and your family’s bikes on one policy, which will automatically include your Multi-bike Discount, with a maximum combined value of £20,000. If you're looking for insurance for bikes and electric bikes over this amount, then please contact us by either:

- Phone: 0333 004 3444

- Email: support@guardcover.co.uk

- How does Cycle Rescue work?

You will receive a contact number for "Call Assist" the recovery breakdown providers. We would recommend that you store this number on your mobile phone or in an accessible place when you are out cycling. Call Assist have over 1,500 recovery agents and will despatch the nearest one to recover you and your bike. They will then travel to your location and transport you to the nearest one of the following:

- A suitable cycle repair shop

- An appropriate railway station

- A car rental agency

- The nearest overnight accommodation

- Your home

- Can you cover drones/UAVs with photoGuard?

Yes, so long as they are used as part of your photographic or filming activity. There are some important requirements and exclusions to be aware of:

- Cover will only apply if you have complied with the legal requirements for drone/UAV operation and any Civil Aviation Authority guidelines.

- Commercial or business use is not covered.

- Drones/UAVs are not covered under the Lend to a Friend, Public Liability, Personal Accident or Mechanical Breakdown sections of cover.

- Drones/UAVs are not covered for any accidental damage that occurs within the first 21 days of the drone/UAV being added to your insurance schedule as an insured item.

- We cannot cover any loss related to drone flyaway and where the drone cannot be recovered.

- Do you insure studios?

No, this policy is designed to cover equipment only and we are unable to provide any cover for premises. You can insure equipment and also benefit from essential liability cover. Please note, photoGuard only covers the equipment you have and we do not provide business insurance or premises cover. But if you are looking for business insurance, our sister company PIB Insurance Broker can help: 0345 450 7171

- What value should I insure my instruments for

For items that can be readily replaced with a new one (or with a similar model), the value should be the usual, undiscounted cost including VAT from a reputable retailer at the time you apply.

- Do I need Public Liability insurance before I start playing gigs

Many venue owners may require musicians to have Public Liability insurance before they can play gigs. Public Liability insurance can cover you if you were to hurt someone or damage their property while you’re performing and for which you are then held liable.

- Do you have to insure a caravan

No, you're not legally required to insure your caravan. However, there is always the risk of accidental damage and recent reports indicate an increase in caravan thefts, despite improved security features. So, ensuring you have the right cover in place is important.

- What does caravan insurance cover

Tourer Select provides a range of cover for British manufactured touring caravans, including cover within the UK and Europe against fire, theft, storms, floods, vandalism and accidental damage. Your accessories and equipment including your essential touring items such as awnings, gas bottles, security devices, fridges and more, can be protected, along with your contents and personal effects. We also include £2m for Public Liability and European cover, as standard.

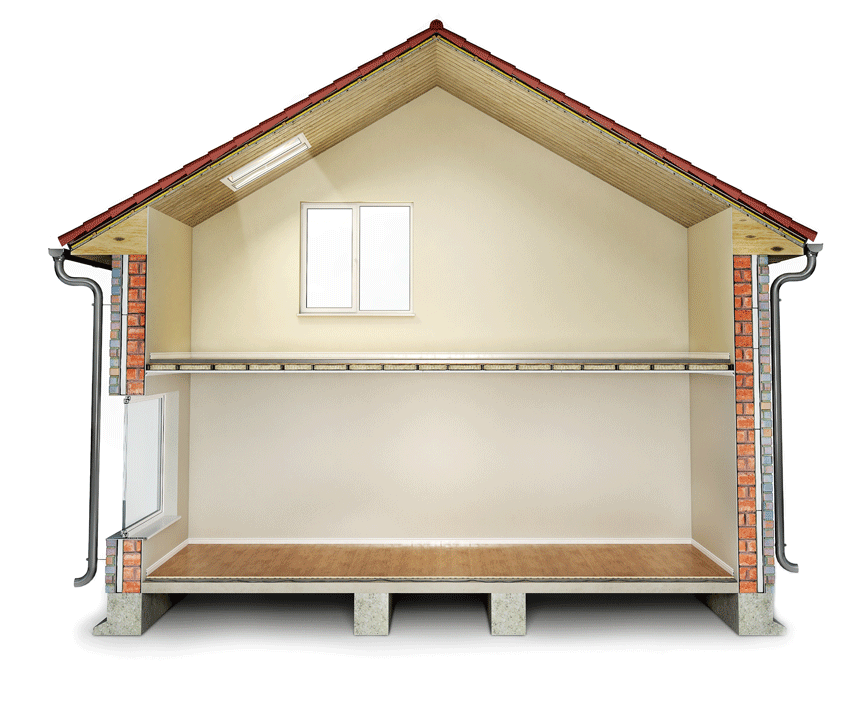

- What is unoccupied home insurance

Unoccupied home insurance covers you when your home is empty for more than 30 days in a row. It may be that there’s a gap in the tenancy, you’re working abroad, or the property is going through a probate or conveyancing process while waiting to be sold. Whatever the reason for the property being unoccupied, you could find that a standard home insurance policy doesn’t provide enough cover or has specific conditions imposed as a requirement of covering the empty home.

- Whats the difference between a vacant and an unoccupied property

Vacant properties are those with no people or personal items in them. For example, an unfurnished house that’s normally rented but currently has no tenants.

Unoccupied properties are those which have personal possessions in them, but where nobody has lived for 30 days in a row, or more. Your property could be unoccupied because you work away from home. Or, it’s a furnished flat that’s normally rented but currently has no tenants. It could also cover any property in probate that still has people living in it.

- Do you only cover UK residents?

Yes. You must be a UK resident and domiciled in the UK.

- Is there an excess on our policies?

All claims are subject to excess unless otherwise stated on your insurance schedule.

- Can I add or make changes to my policy?

Yes, you can make changes to your policy by simply logging in to your online account here, by calling us on: 0345 450 6944, or you can email us at: support@guardcover.co.uk

You can add or delete insured items and change some aspects of your policy. Note that additions will incur additional costs. Additional premiums are charged on a pro rata basis from the date of change. Any cover options that you choose can only be added or removed when you first buy the policy or at renewal.

- Can you cover two addresses on one policy?

If you need cover at more than one address, then you can call our friendly, UK-based team on: 0345 450 6944 and we can discuss your specific requirements.

- Can I set up a policy on behalf of someone else?

As the insurance policy is a legal agreement between us and the policyholder, we can only set up a policy with the person who will be named as the policyholder.

- How can I pay for my policy?

You can choose to pay in full by credit or debit card. Alternatively, you can take advantage of our interest free monthly payment option and simply spread the payments out, without any additional cost.

- I have previously made a claim. Will this affect my cover?

You need to tell us about any related losses or claims you have had within the last three years whether insured or not. It is important that you make an honest disclosure of any previous claims or losses, as if not this could invalidate your cover.

- I have previously had a criminal conviction. Will this affect my cover?

You must disclose any criminal convictions which have not been spent under the Rehabilitation of Offenders Act 1974. If you are in any doubt as to whether this applies to you, you should call us to discuss your individual circumstances.

- Are there any security requirements for my vehicle or where my camera is kept?

At your insured location (where your equipment is usually kept, which should also be your main place of residence). For cover to apply whilst your items are at your insured location, please be aware that your items must be kept within the main structure of your insured location.

Cover in an unattended vehicle

Theft or attempted theft from a vehicle will only be covered if your insured item is stored out of sight, in an enclosed storage compartment, boot or luggage space. All vehicle doors and windows must be closed and securely locked, and all vehicle security systems activated.

All insured items need to be removed and stored when your vehicle is at your insured location. In-Vehicle Cover does not apply when the vehicle is at your insured location.

Accidental damage that occurs in a vehicle is only covered if the insured item is in a purpose-designed equipment case. If your equipment is in transit with an airline transport provider, see here for more information relating to airline cover.

For any theft claims, whether at your insured location, storage location or from a vehicle, you need to report the incident to the police and there must be evidence of forcible and/or violent entry or evidence of unauthorised access.

- Does your policy cover bikes stored outside overnight?

When your bike is within the direct boundaries of your insured location (where your insured bike(s) is usually kept, which should also be your main place of residence), and if it is not being stored in a fully enclosed and locked building or cycle storage unit, your bike needs to be locked to an immovable object through the frame of the bike, with an approved lock.

If the bike is stored in a communal hallway it will only be covered if the hallway is on the same floor as your insured location and, again, your bike needs to be locked to an immovable object, through the frame of the bike, with an approved lock. The same lock requirements apply if your bike is stored in a “Communal Cycle Storage Area”.

When you are away from the home, such as at a campsite, you would be able to lock the bike to an immovable object with an approved lock, through the frame of the bike and leave it unattended for up to 24 hours.

- Are there any security requirements for my vehicle or where my instruments are kept?

At your insured location (This is where your instruments are usually kept and should also be your main place of residence or your music business premises or studio): For cover to apply while your instruments are at your insured location, the insured items must be kept within the main structures (must be brick or stone built) of your insured location and all normal security protections are in force.

Cover in an unattended vehicle: Theft or attempted theft from a vehicle will only be covered if your insured item is stored out of sight, in an enclosed storage compartment, boot or luggage space. All vehicle doors and windows must be closed and securely locked, and all vehicle security systems activated.

All insured items need to be removed and stored inside your insured location when your vehicle is at your insured location. In-vehicle cover does not apply when the vehicle is at your insured location.

Accidental damage that occurs in a vehicle is only covered if the insured item is in a purpose-designed equipment case. If your musical instruments are in transit with an airline transport provider, see the FAQ relating to airline cover.

For any theft claims, whether at your insured location, storage location or from a vehicle, you need to report the incident to the police and there must be evidence of forcible and/or violent entry or evidence of unauthorised access.

- Do I need specific security for my caravan?

Yes, as a minimum, your caravan needs to be fitted with a hitch lock and one of the following: an alarm, hitch post or wheel clamp. Further security discounts are automatically included for other specific security features.

- How can you protect your unoccupied home from squatters?

You can reduce the risk of your unoccupied home being targeted by squatters. Make sure the property is well-secured by locking all doors and windows. Consider installing a security system or alarm, too. Not only will this help deter squatters, but it means we can offer you a discount on your policy.

making a claim with guardcover

We've made making a claim so easy

Our easy-to-use claims process is listed below with some helpful information regarding what to do if you need to make a claim.

1. Call the police

If you’ve been the victim of theft or malicious damage, your first port of call should be to inform the police.

2. Contact our claims team

Contact our in-house UK team to make your claim.

You can call us on: 0333 004 1999 to get started, or alternatively, you can email us with details of your claim at: claims@guardcover.co.uk

3. Make your claim

We'll provide you with your claim reference and talk you through the next steps. Should we need any further information to help process your claim, we can explain what's needed and support you.

Read our latest articles and guides

Whether your a pet owner, cyclist, photographer, golfer, musician, caravanner or have a property that needs insuring, you can find hints and tips, as well as a number of articles and guides that could be of interest to you!